santa clara county property tax exemption

Codes 6103 27201 27261 The document must be in compliance with state and local laws. See who is exempt from Special Assessment parcel taxes.

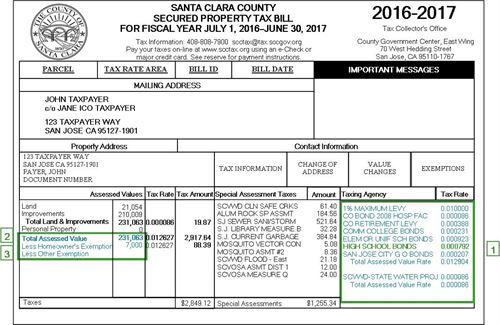

Understanding California S Property Taxes

These taxes are flat rate and are non-ad valorem meaning that they are not based on the assessed value of the property.

. Senior citizens and blind or disabled persons in Santa Clara County can apply for a postponement on their property tax as long as they are at least a 40 owner of the property and. CC 1169 The document must be authorized or required by law to be recorded. See who is exempt from Special Assessment parcel taxes.

The property must be located in Santa Clara County. Santa Clara establishes tax levies all within California statutory directives. To claim the exemption the homeowner must make a one-time filing with the county assessor where the property is located.

Failure to claim exemptions to be deemed waiver. If Santa Clara County property tax rates have been too costly for you resulting in delinquent property tax. Learn Everything You Need to Know About School Parcel Tax Exemptions in Santa Clara County.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. The home must have been the principal place of residence of the owner on the lien date January 1st. This translates to annual property tax savings of approximately 70.

Parcel taxes are real property tax assessments available to cities counties special districts and school districts. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. Code 27201 The document must be submitted with the proper fees and applicable taxes.

Exemptions granted or authorized by Sections 3 e 3 f and 4 b apply to buildings under construction land required for their convenient use and equipment in them if the intended use would qualify the property for exemption. The application period for the 2022 Low-Income Senior Exemption Safe Clean Water Tax is April 15 2022 - June 30 2022. You could be exempt from the tax if you meet all of the following criteria.

Owners must also be given an appropriate notice of rate escalations. If Santa Clara County property tax rates have been too costly for you resulting in delinquent property tax. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property.

Special Assessments are taxes levied for specific projects and services. Determine how much your real real estate tax payment will be with the increase and any tax exemptions you qualify for. 28 rows Los Gatos Exemptions Info and Application.

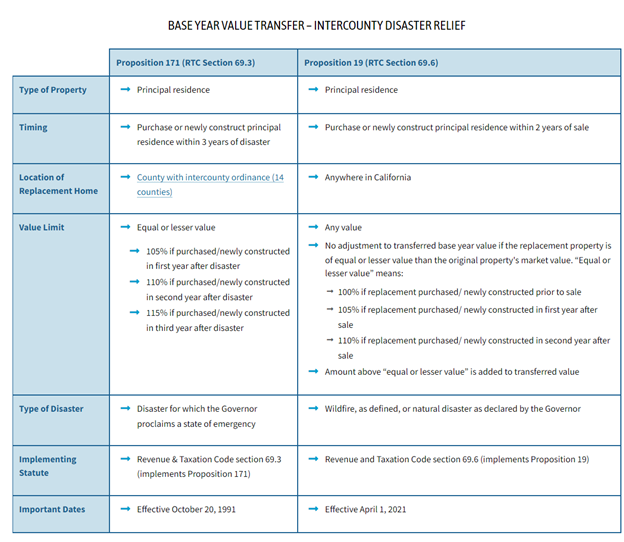

California Property Tax Exemption at Age 55 in a Nutshell. Property owners who occupy their homes as their principal place of residence on the lien date January 1st and each year thereafter are eligible. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax.

The HOMEOWNERS EXEMPTION is essentially a tax break for homeowners who own and occupy their primary residence dwelling on January 1. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median. You were born before June 30 1958.

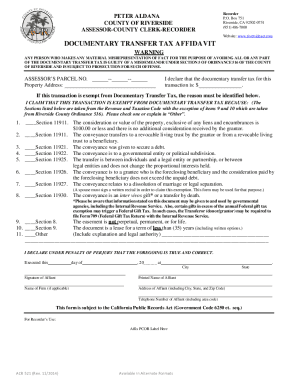

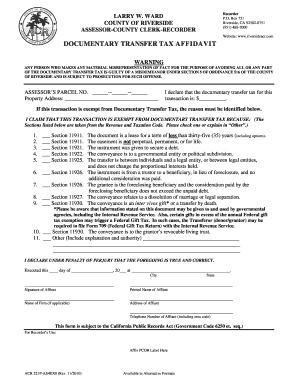

A Real Estate Property Transfer Tax is a one-time tax paid whenever real property is sold or transferred from one individual or entity to another. The California Constitution provides a 7000 reduction in the taxable value for a qualifying owner-occupied home. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence.

The failure in any year to claim. Homeowners are eligible to receive a reduction of up to 7000 of the property s assessed value 70 annual savings per year. Learn more about SCC DTAC Property Tax Payment App.

The City of San Joses current real estate property transfer tax is 330 per 1000 of assessed value. County of Santa Clara. Santa Clara County homeowners over 65 can apply for a tax credit to be offset against their property tax bill.

On Monday April 11 2022. What appears to be a significant increase in value may only give a tiny increase in your property tax payment. The tax was renewed and approved by the voters in November 2020.

SCV Water District Exemptions Info and Application. What is a HOMEOWNERS EXEMPTION. April 15 - June 30.

31 rows Franklin-McKinley Exemptions Info and Application. Program Requirements for 2022. Exemptions To The Transfer Tax Santa Clara County.

Who pays transfer tax in Santa Clara County. To receive the exemption an applicant must file a Welfare Exemption Claim Form BOE-267 between the January 1 lien date and 5. Article XIII Section 6.

If you are contacting or receiving email from the Assessors Office please provide your personal contact and parcel number. Santa Clara Valley Water District. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments.

East Side Union High School District Bond Measure Faqs

Santa Clara County Office Of The Assessor Facebook

Standards And Services Division

What You Should Know About Santa Clara County Transfer Tax

Property Taxes Department Of Tax And Collections County Of Santa Clara

What You Should Know About Santa Clara County Transfer Tax

Property Taxes Department Of Tax And Collections County Of Santa Clara

Milpitas Community Briefs For The Week Of April 15 The Mercury News

2014 2022 Form Ca Acr 521 Fill Online Printable Fillable Blank Pdffiller

Title Wave New England Marine Title Newsletter Marine Documentation Services

Santa Clara County Transfer Tax Form Fill Out And Sign Printable Pdf Template Signnow

Secured Property Taxes Treasurer Tax Collector

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara